Can I ask you a question? Do you own a car? I’m going to assume that you do for the sake of this example.

Now, would you agree that you and I have been taught that there are two ways to buy a car? What are they?

“Finance it or pay cash”

Correct! That is how we’ve been taught to buy a car. But did you know there is a THIRD way? A way that allows you to grow your wealth merely by changing how you buy your cars?

Before we get into the specifics of the third way, there is a principle you must understand: we finance everything we buy. We either pay interest to someone else for the use of their money, or we LOSE the interest we otherwise could have earned when we pay cash.

Think about that for just a second—when you “pay cash” what have you given up? You’ve not only given up the cash you saved up, but you’ve given up the opportunity to EARN interest on that cash for the rest of your life.

I like to call this a “piggy bank” mentality: save money up, break open the piggy bank and spend all the cash, then get a new piggy bank and start the whole process all over again.

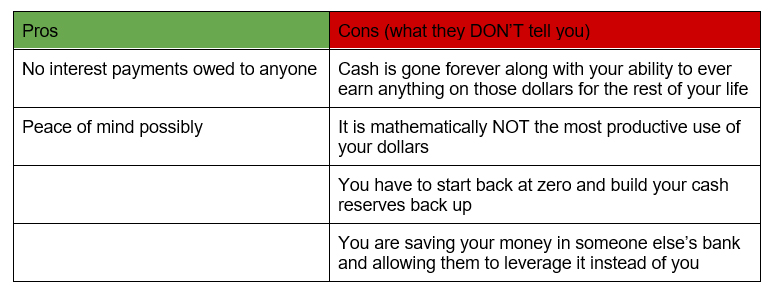

For those of you who like things listed in table format (like myself) here is a list pros and cons for “paying cash” like you have been taught to do by financial entertainers:

So what’s the solution? Dividend-paying whole life insurance contracts.

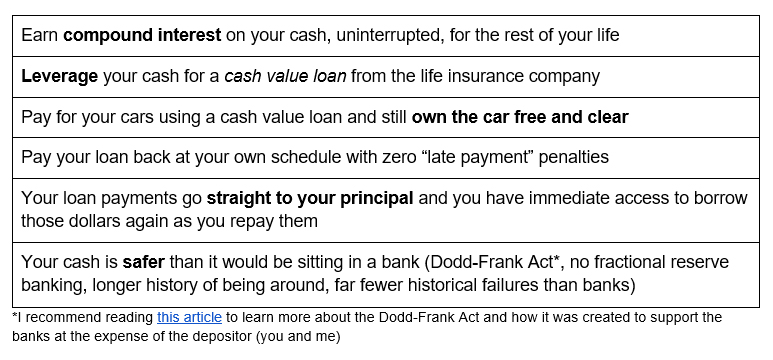

Let’s take a look at the benefits of “paying cash” by using a cash value loan instead:

*I recommend reading this article to learn more about the Dodd-Frank Act and how it was created to support the banks at the expense of the depositor (you and me)

It’s time to start thinking like a Bank Owner, and not a piggy-bank owner. By saving your capital in your own banking system and leveraging it for the use of the insurance company’s money, you will create significantly more wealth during your lifetime than doing things the ‘conventional’ way.

If you’d like to hear an expanded discussion on this very topic, tune into episode 22 of the Wealth Warehouse podcast.

Cheers, David